UPDATE: AS OF 10TH MAY 2022, ALL CREDIT AND DEBIT CARDS ARE NOW ACCEPTED FOR YOUR SANDBOX SUBSCRIPTION.Further to the circular (issued on 21 Aug 2019) and the press release (issued on 31 March 2021), RBI released a new circular on 31 March 2021, regarding registration of new card mandates. You can find the new RBI circular here.

What does the directive entail?

The RBI Directive essentially issues certain guidelines for issuing banks to authorize mandates and for collection of recurring card payments. The intent is to make recurring card payments safer and secure. Also, no new standing instructions/recurring card payments can be set up from 1st April until the issuing banks comply with the following guidelines.

- All mandate registrations must go through Additional Factor of Authentication (AFA). AFA is a process wherein a customer receives an OTP or card PIN during modification or revocation of the mandate and the first transaction.

- AFA is mandatory for registering mandates on cards and for payments above ₹5,000. You can refer to the RBI circular.

- At the time of registration, banks should provide customers with the option to choose the communication medium (SMS or email) to which the pre-debit notifications will be sent.

- Banks should send customers a pre-debit notification at least 24 hours before the actual debit. The notification must contain all the information regarding the upcoming debit. Customers should be provided with an option to opt-out of the particular debit or the mandate.

- Banks should also send a post-debit notification to the customers. This notification should contain all the information regarding the debit.

- Banks must provide customers with an online facility through which customers can withdraw from any e-mandate at any point in time. The customers will have to perform the AFA at the time of withdrawal.

- For all such withdrawn e-mandates, the acquiring banks should ensure that the respective businesses delete all customer payment information.

- Banks should set-up redressal system to address customers grievances. Card networks should also have in place a dispute resolution mechanism.

What does this mean for you?

Due to this irregularity, your payments for subscriptions/free trial activation will not go through via credit/debit card. This is a temporary situation and we estimate it will be resolved by the issuing banks. This means that when you try to access the free trial or a paid subscription, credit/debit card as a payment method will fail for you.

What is the immediate solution to this?

The immediate solution is to resort to UPI Autopay as a payment method. UPI Autopay facilitates a similar transaction mechanism as recurring card payments but through UPI ID. This payment method will be available to you as one of the options while setting up the free trial or paying for a new subscription.

Currently, UPI Autopay is supported only on UPI IDs registered with BHIM or PayTM app so please make sure to use appropriate application to complete the payments.

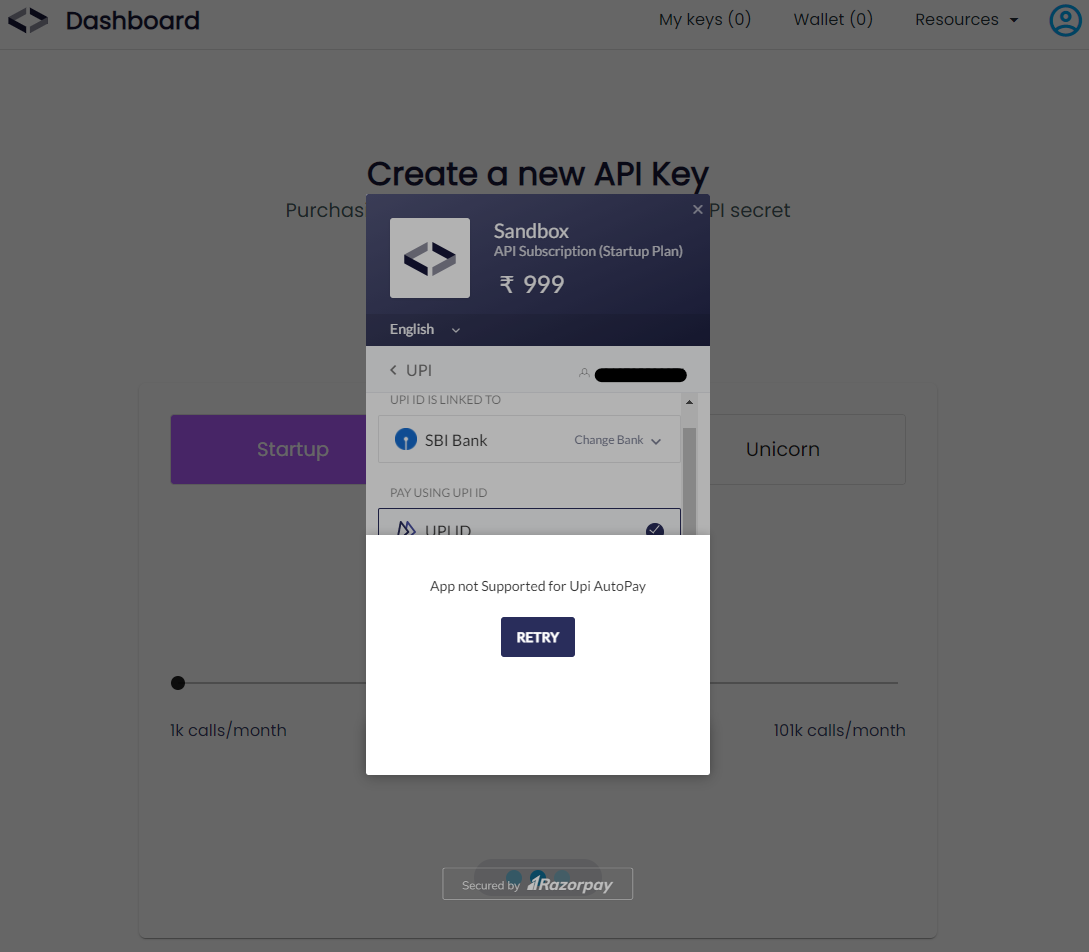

Following message will be shown in case the UPI Application does not support autopay i.e. If you use other applications like Google Pay and PhonePe:

Following message will be shown in case the UPI Application supports autopay i.e. If you use BHIM or PayTM:

Furthermore, you can authorize the request received on your phone and proceed with the subscription.

What is Sandbox doing to resolve this situation?

We are closely working with our Payment Gateway Razorpay to provide our customers with more payment method options like E-mandate, UPI Autopay, etc. We are closely monitoring any updates regarding further communication by RBI and the issuing banks on the same.

Additionally, to onboard customers having billables beyond the permissible limit of UPI Autopay (i.e. ₹5000 per transaction) we will be engaging them in a hybrid fashion of payment by providing a Standing Instruction of ₹1 on their UPI Autopay while processing the remaining payment for subscriptions through a separate payment method by issuing an invoice for the same. This is a temporary solution and we encourage all the customers to treat it as one. Once the situation is resolved by the issuing banks, we will request the customers to return to recurring card payments as a primary option. Please reach us at help@quicko.com if you need the same and meet the transaction criteria.

Does it affect my subscriptions created before 1st April?

No, this does not affect the existing subscriptions before 1st April and the payment methods set up before 1st April. The recurring card payments set up before 1st April 2021 will go through as usual till 31st September 2021.

While this is an unusual situation, we request our customers to be patient as we are trying our best to minimize the impact of this regulation on the modus operandi and operations of customers engaged with Sandbox.

For any queries or help needed, please contact us at help@quicko.com.